“Thou shalt not have in thy bag divers weights, a great and a small. Thou shalt not have in thine house divers measures, a great and a small. But thou shalt have a perfect and just weight, a perfect and just measure shalt thou have: that thy days may be lengthened in the land which the Lord thy god giveth thee.” (Deuteronomy 25:13,15)

Money

(The substances of creation. - payment)

vs.

Mammon

(The promises of liars. - debt)

“All the perplexities, confusion and distress in America rise … from downright ignorance of the nature of coin, credit and circulation”

Money is “any medium of exchange that is widely accepted in payment for goods and services and in settlement of debts.” From sea shells and wampum to clay scarabs and stones, almost everything that can be imagined as having value has, at one time or another, been used for money.

“Money is the just medium and measure of all commutable things, for by the medium of money a convenient and just estimation of all things is made.”

There are three basic types of money. The first is commodity money, which has included gold, silver, and copper and are normally exchanged for equal value of the materials contained within them.

“Gold in the hands of the public is an enemy of the state.” Adolph Hitler

The second type is credit money, which is paper money, backed by promises to pay an equivalent value in some standard form of commodity money.

“Payment is the fulfillment of a promise.”

“Behold, ye trust in lying words, that cannot profit.” (Jer 7:8)

The third form has no intrinsic value nor is it backed by a promise to pay something of value. Its value is fixed merely by government edict and is known as unfunded paper money or fiat money.

"But if in the pursuit of the means we should unfortunately stumble again on unfunded paper money or any similar species of fraud, we shall assuredly give a fatal stab to our national credit in its infancy. Paper money will invariably operate in the body of politics as spirit liquors on the human body. They prey on the vitals and ultimately destroy them. Paper money has had the effect in your state that it will ever have, to ruin commerce, oppress the honest, and open the door to every species of fraud and injustice."

“It has long been long settled that a promise made in consideration of an act is forbidden by law is void. It will not be questioned that an act forbidden by the Constitution of the United States, which is the Supreme Law, is against Law.”

Coins may be either commodity money or fiat money, depending on the value of the metal they are made from. Paper currency may be either credit money or fiat money. With selective redeemability, currency may, in some cases, be both. These paper currencies may be interest-bearing or not. Paper currencies may come in a myriad of forms, such as government notes, silver certificates, bank notes, as well as checks which are drawn on bank deposits and are called deposit currency.

“Just balances, just weights, a just ephah, and a just hin, shall ye have: I [am] the LORD your God, which brought you out of the land of Egypt.” (Le 19:36)

The development of commodity monies is the result of the natural progression of trade, while the development of credit and fiat money is usually the result of greed, ambition, and ignorance.

“Whoever controls the volume of money in any country

is absolute master of all industry and commerce.”

“My son, if sinners entice thee, consent thou not. If they say, Come with us, let us lay wait for blood, let us lurk privily for the innocent without cause: Let us swallow them up alive as the grave; and whole, as those that go down into the pit: We shall find all precious substance, we shall fill our houses with spoil: Cast in thy lot among us; let us all have one purse: My son, walk not thou in the way with them; refrain thy foot from their path: For their feet run to evil, and make haste to shed blood. Surely in vain the net is spread in the sight of any bird. And they lay wait for their [own] blood; they lurk privily for their [own] lives. So [are] the ways of every one that is greedy of gain; [which] taketh away the life of the owners thereof.”

“Wisdom crieth without; she uttereth her voice in the streets: She crieth in the chief place of concourse, in the openings of the gates: in the city she uttereth her words, [saying], How long, ye simple ones, will ye love simplicity? and the scorners delight in their scorning, and fools hate knowledge? Turn you at my reproof: behold, I will pour out my spirit unto you, I will make known my words unto you. Because I have called, and ye refused; I have stretched out my hand, and no man regarded; But ye have set at nought all my counsel, and would none of my reproof: I also will laugh at your calamity; I will mock when your fear cometh; When your fear cometh as desolation, and your destruction cometh as a whirlwind; when distress and anguish cometh upon you. Then shall they call upon me, but I will not answer; they shall seek me early, but they shall not find me: For that they hated knowledge, and did not choose the fear of the LORD: They would none of my counsel: they despised all my reproof. Therefore shall they eat of the fruit of their own way, and be filled with their own devices. For the turning away of the simple shall slay them, and the prosperity of fools shall destroy them. But whoso hearkeneth unto me shall dwell safely, and shall be quiet from fear of evil.” (Proverbs 1:10, 33)

“Banking was conceived in iniquity and was born in sin. The Bankers own the earth. Take it away from them, but leave them the power to create deposits, and with the flick of the pen they will create enough deposits to buy it back again. However, take it away from them, and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of Bankers and pay the cost of your own slavery, let them continue to create deposits.”

“Interest is the invention of Satan.”

Credit money being redeemable in commodity money may seem to have some advantages. If credit money or fiat money is loaned into circulation, then the interest can provide large gains for the issuer in excess of the amount of commodity money backing the original issue of paper currency.

“America will never be destroyed from the outside. If we falter and lose our freedoms, it will be because we destroyed ourselves.”

If paper money is destroyed, only the bearer has lost its value. The issuer continues to hold the commodity that backed the note, as well as the profit, benefit, and gain derived from the issuance. “History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and it's issuance.”

“A great industrial Nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the world---no longer a Government by the opinion but by the duress of small groups of dominant men.”

This credit money is only a shadow of what commodity money is. "We have, in this country, one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board. This evil institution has impoverished the people of the United States and has practically bankrupted our government. It has done this through the corrupt practices of the moneyed vultures who control it.”

The passage of the Federal Reserve Act “opened the way to a vast inflation of the currency... in a flood of irredeemable paper currency.” “From now on, depressions will be scientifically created.” “By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” “The regional Federal Reserve banks are not government agencies. ...but are independent, privately owned and locally controlled corporations.” “The financial system has been turned over to the Federal Reserve Board. That Board administers the finance system by authority of a purely profiteering group. The system is Private, conducted for the sole purpose of obtaining the greatest possible profits from the use of other people's money”

“Beware lest you lose the substance by grasping at the shadow.”

One of the most important disadvantage of paper currencies is probably the least understood. All credit money is mere legal tender and the bearer can pay for nothing with them. That is to say that the one offering them for payment of debt, in the purchasing of a thing, is able to do so only because the issuer of the obligation to pay the redemption value of the note is assisting in the actual deliverance of the purchase price. So, although the bearer of the note may purchase a legal title, he has not actually purchased the item itself, failing to deliver present value. At the same time, he is creating a constructive trust.

“A little leaven leaveneth the whole lump.” (Ga. 5:9 )

Remember money does not work for you. “I think we have more machinery of government than is necessary, too many parasites living on the labor of the industrious.” Money cannot sweat; it can not toil. It is people who pay interest, who do the work, and sweat under the burdens of debt so that others, who already have, may obtain even more for doing less.

“Of all contrivances for cheating the laboring classes of mankind, none has been more effective than that which deludes them with paper money”

“If thou lend money to [any of] my people [that is] poor by thee, thou shalt not be to him as an usurer, neither shalt thou lay upon him usury.” (Ex 22:25)

“Banking institutions are more dangerous than standing armies.”

Divers weights [are] an abomination unto the LORD; and a false balance [is] not good. (Pr 20:23)

It is also important to understand an interesting phenomena described by Gresham’s Law. When good, full, intrinsic value commodity money is circulated along side a depreciated or debased currency the “bad money drives out good.” So, in other words, precious metal money will eventually be replaced by credit and fiat money, not because it is better, but because it is worse.

“They shall cast their silver in the streets, and their gold shall be removed: their silver and their gold shall not be able to deliver them in the day of the wrath of the LORD: they shall not satisfy their souls, neither fill their bowels: because it is the stumblingblock of their iniquity.” (Eze.7:19)

“Spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.” “… 100% of what is collected is absorbed solely by interest on the Federal Debt … all individual income tax revenues are gone before one nickel is spent on the services taxpayers expect from government”.

In order to sustain paper currency, it is necessary to back it with redeemability in a commodity money, at least at first. There is a long history of monetary systems using a bimetallic or a gold standard, with a total or limited redeemability. Because of a greedy process of devaluation to stimulate foreign trade or an over indulgent issuance policy, after a period of time, it would seem to become necessary to restrict redemption. Roosevelt in 1933, with his HJR 192 and a “modified gold bullion standard,” blocked redeemability of notes into gold for citizens of this nation. This was due to the fact that it was illegal for citizen of the United States to own gold.

“It is well that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

“In 1978, in conjunction with reforms made by the International Monetary Fund, Congress formally removed the United States from the gold standard on an international basis.

Divers weights, [and] divers measures, both of them [are] alike abomination to the LORD. (Pr 20:10)

The 1792 Coinage Act describes the weight, content, and purity of US coins. The law also prescribed the penalty for anyone found guilty of debasing the coin. Looking at Sec.19 of said act, “And be it further enacted, That if any of the gold or silver coins which shall be struck or coined at the said mint shall be debased . . . . every such officer or person who shall commit any or either of the said offenses, shall be deemed guilty of felony, and shall suffer death.”

Yet, at the end of the 1970’s, no major currency was redeemable in gold for citizens. As of December 31, 1974, private citizens have been allowed to own gold, but not to use it “as currency.”

“No State shall… make anything but gold and silver coin a tender in payment of debts,… impairing the obligation of contracts” Sec 10, Art I, The Constitution of the United States.

“I see in the future a crisis approaching that unnerves me, and causes me to tremble for the safety of our country; corporations have been enthroned, an era of corruption in high places will follow, and the money power of the country will endeavor to prolong its reign by working upon the prejudices of the people, until the wealth is aggregated in a few hands and the public is destroyed.”

“The world has always been betrayed not by scoundrels but by decent men with bad ideas.”

“This (Federal Reserve) Act establishes the most gigantic trust on earth. When the president signs this bill, the invisible government by the Monetary Power will be legalized. The people may not know it immediately, but the day of reckoning is only a few years removed. The trust will soon realize that they have gone to far even for their own good. The people must make a declaration of independence to relieve themselves from the Monetary Power.”

“No man can serve two masters: for either he will hate the one, and love the other; or else he will hold to the one, and despise the other. Ye cannot serve God and mammon.” (Mt. 6:24)

“Mammon, an Aramaic word mamon meaning ‘wealth’ … It is probably derived from Ma’amon, something entrusted to safe keeping. In any case there was apparently a threefold play on this meaning in Lk. xvi. II: ‘If therefore ye have not been faithful in the unrighteous mammon, who will commit to your trust the true [riches]?’ the word italicized representing forms of the Semitic root word ‘men.”

That most gigantic trust on earth was to be (and is now established) constructed in a very interesting way. It involved the entrusting of almost all the wealth, property, and rights of man, granted to him by God, into a world-wide trust. It was a process not limited to the money system, but it is that system that is focused on in these pages.

This was not the first attempt to accomplish these ends, nor will it be the last. The so-called Civil War had begun to collateralize the debt of the federal government. By 1872, in response to “National Bank Act,” Horace Greeley stated his perception of the changing civil situation in no uncertain terms when he said, “We have stricken the shackles from four million human beings and brought all laborers to a common level, not so much by the elevation of former slaves as by practically reducing the whole working population, white and black, to a condition of serfdom. While boasting of our noble deeds, we are careful to conceal the ugly fact that, by our iniquitous money system, we have nationalized a system of oppression which, though more refined, is no less cruel than the old system of chattel slavery.”

Internalizing the debt saved America for a short while. But the Federal Reserve Act again pushed the process of collateralizing the debt and title to everything in America and, eventually, the world into a massive collective trust.

There has been only one real attempt to undue this process on a governmental basis. Kennedy had prepared to print four billion dollars in US notes to replace the Federal Reserve notes. He began to bring troops back from Vietnam, he signed a series of Executive Orders in preparation for total economic depression if and when the money powers made their move to collapse the economy as they had done in 1929. Robert Kennedy, as Attorney General, had realized the collateralization of US debt which made every piece of land and natural resource, all livestock, factories, and machinery, as well as the people themselves, nothing more than chattel for the security and surety of debt. Kennedy’s plans died with him and all his efforts were thwarted by Johnson.

“My son, if thou be surety for thy friend, [if] thou hast stricken thy hand with a stranger, with the words of thy mouth… How long wilt thou sleep, O sluggard? when wilt thou arise out of thy sleep? [Yet] a little sleep, a little slumber, a little folding of the hands to sleep: So shall thy poverty come as one that travelleth, and thy want as an armed man.” (Proverbs 6:1,11)

“This note is legal tender for all debts public and private and is redeemable in lawful money at the United States Treasury or at any Federal Reserve Bank” Originally printed on all Federal Reserve Notes.

Here is where several ideas began to come together. If legal tender at one point is redeemable in lawful money, then it is not lawful money. Legal tender can only buy a legal title, not a lawful one.

“There is a distinction between a 'debt discharged' and a debt 'paid'. When discharged the debt still exists, though divested of its character as a legal obligation during the operation of the discharge. Something of the original vitality of the debt continues to exist which may be transferred, even though the transferee takes it subject to its disability incident to the discharge. The fact that it carries something which may be consideration for a new promise to pay, so as to make an otherwise worthless promise a legal obligation, makes it the subject of transfer by assignment.”

“For whoremongers, for them that defile themselves with mankind, for menstealers, for liars, for perjured persons, and if there be any other thing that is contrary to sound doctrine; Whose mouths must be stopped, who subvert whole houses, teaching things which they ought not, for filthy lucre’ sake.” (1Ti 1:10 )

Here again, we see the process of creating a legal title and a constructive trust. “Legal title” is, “One cognizable or enforceable in a court of law, or one which is complete and perfect so far as regards the apparent right of ownership and possession, but which carries with it no beneficial interest in the property, another person being equitably entitled thereto; in either case, the antithesis of ‘equitable title.” So, with your legal title, you now have only an apparent right of ownership and possession, but no right to the beneficial interest, which raises a constructive trust.

A “Constructive trust” is, “A trust raised by construction of law, as distinguished from an express trust. Wherever the circumstances of a transaction are such that the person who takes the legal estate in property cannot also enjoy the beneficial interest without necessarily violating some established principle of equity, the court will immediately raise a constructive trust, and fasten it upon the conscience of the legal owner, so as to convert him into a trustee for the parties who in equity are entitled to the beneficial enjoyment.”

“BENEFICIAL INTEREST” is the, “Profit, benefit, or advantage resulting from a contract, or the ownership of an estate as distinct from the legal ownership or control.” It should be clear that, although a legal title may appear to grant ownership or a right to the profit and benefit, it does not.

We can also see that a legal title is the antithesis of ‘equitable title. “An equitable title is a right in the party to whom it belongs to have the legal title transferred to him; or the beneficial interest of one person whom equity regards as the real owner, although the legal title is vested in another.” So, again it is clear that a person holding a legal title to property, whether it is real or personal property, is not the real owner, even though the legal title is vested in him. Also, it should be noted that the legal title can be removed from the one holding it and transferred by right to the one holding the equitable title.

The one holding title has been called a “feoffee to uses” which is, “A person to whom land was conveyed for the use of a third party. (The latter being called 'cestui que use.') One holding the same position with reference to a use that a trustee does to a trust.” He answers to the ‘hares fiduciarius’ of the Roman law.”

“§ 30. Bona fide purchase for value---(1) paying value. In 1450 equity gave a remedy against a trustee or feoffee to uses but not against his transferee unless he to expressly undertook the trust. This… soon hardened into a rigid rule that the transferee was bound whether he did or did not undertake the trust; the obligation thus being imposed or constructed by equity… called a constructive trust and the doctrine was extended to all cases where a defendant would be unjustly enriched with specific property at the plaintiff’s expense including cases where the conveyance was in fraud of equities of specific performance, reformation of instruments, equitable mortgage and recision....”

“A judgment creditor is not a bona fide purchaser for value because he gives no present value for the property upon which his judgment is a lien and also because he gets no title to it; but if he buys the property at the execution sale he is regarded as then giving value because he credits the amount of the purchase price on his claim” In the first paragraph we see that it has become a rigid rule that the constructed trust must be honored. The problem is that the purchaser of a legal title is not a Bona fide purchaser for value because he has left an Unperformed obligation of payment to the issuer of the note’s obligation, under seal and treaty.

“I hope we shall crush in its birth the aristocracy of the moneyed corporations, which dare already to challenge our Government to trial of strength and bid defiance to the laws of our country.” “The interests of the corporation state are to convert all the riches of the earth into dollars.” “If all bank loans were paid … there would not be a dollar of coin or currency in circulation. Someone has to borrow every dollar we have in circulation. We are absolutely without a permanent money system”

The United States, and the world in general, has gone off the gold standard, but has not yet removed the notes of obligation from circulation. [Since I originally wrote this, the new notes under a new seal are steadily replacing the old notes under seal. The notes are not returned to the United States or Washington D.C. They are not municipal notes from Washington D.C., but are a new “will, deed or testate written entirely by the hand of the testator”.]

“Faith must be kept; the simplicity of the law of nations must prevail. A rule applied to bills of exchange as a sort of sacred instruments.”

For the trust to succeed, the seal and obligation must be honored or the sealed notes must be replaced in timely fashion with a different note.

“Criminal: A person with predatory instincts who has not sufficient capital to form a corporation.”

“... the [Federal] Reserve Banks are not federal … but are independent, privately owned and locally controlled corporations … without day to day direction from the federal government.”

The constructive trust created by the Federal Reserve Act, and the years of almost exclusive use of their notes and banks, has eventually reduced almost all the land of the United States to a mere legal title, with the equitable title and true ownership held in a public trust that is bankrupt.

“No one is considered to be solvent unless he can pay all that he owes.”

This constructive trust is a three-party trust, with the citizens of the United States as both beneficiary and surety for the debts of the trust. The United States Federal Government is the issuer of the obligation of the notes and the Federal Reserve is the issuer of the notes, as well as the owner of the notes, having bought them from the United States.

“Be not thou [one] of them that strike hands, [or] of them that are sureties for debts.” (Pr 22:26)

It is eventually necessary to issue notes entirely from a single source in order to execute the trust (This is now the case with the new notes in circulation). Those notes will be, in their entirety, fiat money. They shall have no true value except what is placed on them by edict. They shall also be holographs. The sealed notes shall return to the new issuer and the equitable title and ownership of all property, things, and choses still in the trust shall be transferred to the possessor of the original notes.

“Every effort has been made by the Federal Reserve Board to conceal its powers, but the truth is… the Fed has usurped the government. It controls everything here (Congress) and it controls all our foreign relations. It makes and breaks governments at will!”

“There are two types of notes the Federal Reserve is allowed to issue (Federal Reserve Act of 1913), the first is the Federal Reserve Note. The currency of the United States exists in several forms, but the predominate note is the Federal Reserve Note, although most of the money in circulation is in the form of entries in bank books as a result of borrowing. The second type of note is the Federal Reserve Bank Note which have not been used since 1935.

“A ‘fiduciary relation’ exists when confidence is reposed on one side and there is resulting superiority and influence on the other, which relation need not be legal, but may be moral, social, domestic, or merely personal.”

“Each note includes the following features: the seal, number, and letter of the Federal Reserve Bank that issued the note; the seal of the Department of the Treasury; the serial number; the year when the note was designed; and the printing plate identification numbers.” The phrase “This note is legal tender for all debts public and private and is redeemable in lawful money at the United States Treasury or at any Federal Reserve Bank” was removed from the notes, but it was not that phrase that made them redeemable, but the seal and obligation of the Treasury.

This resulting cestui que charitable trust, through the process of equitable conversion, brings all the property bought over the last generation with these notes into the most gigantic trust on the face of the earth.

“Thus saith the LORD, thy redeemer, and he that formed thee from the womb, I [am] the LORD that maketh all [things]; that stretcheth forth the heavens alone; that spreadeth abroad the earth by myself; That frustrateth the tokens of the liars, and maketh diviners mad; that turneth wise [men] backward, and maketh their knowledge foolish;” (Isaiah 44:24, 25)

How can this be, that everything you thought that you owned is owned by another? Is there any way to own and possess Gods gifts again?

“A trust is an obligation of conscience of one to the will of another.”

Remember a “TRUST” is, “A right of property, real or personal, held by one party for the benefit of another. An obligation arising out of a confidence reposed in the trustee or representative, who has legal title to property conveyed to him, that he will faithfully apply the property according to the confidence reposed, or in other words, according to the wishes of the grantor of the trust… an equitable obligation, either express or implied, resting upon a person by reason of a confidence reposed in him, to apply or deal with property for the benefit of some other person, or others, according to such confidence… ‘Trust’ is further defined in a broad comprehensive sense as a relation between two persons, by virtue of which one of them holds property for the benefit of the other… and as a confidence reposed in one person, by and for the benefit of another, with respect to property held by the former, for the latter’s benefit.”

A constructive trust is an implied trust, which is “raised or created by implication of the law; a trust implied or presumed from circumstances” or an “Imperfect” or “Executory trust” “which requires the execution of some further instrument, or the doing of some further act, on the part of the creator of the trust or of the trustee, towards its complete creation or full effect” and is distinguished from an express trust or executed trust.

An “Executed trust” is, “A trust of which the scheme has in the outset been completely declared*… A trust in which the estates and interest in the subject-matter of the trust are completely limited and defined by the instrument creating the trust, and require no further instrument to complete them.”

“Fear can only prevail when victims are ignorant of the facts”

Some new instrument must give notification of trust; it would be a holographic testament and it would be issued entirely by the Federal Reserve with agreements guaranteeing its acceptance, most likely set forth or backed through world organizations like the Internationl Monetary Fund (IMF) and the United Nations. This new instrument of exchange (fiat money) would no longer be the same kind of note and would mark the execution of the trust. It would allow for the removal from circulation the notes under seal and obligation {See new notes in circulation].

Is there any escape from this world-wide trust? Can you ever return to a lawful title? Can a mere legal title and an equitable title be restored or recombined into a good and complete title?

“Things which have not yet been introduced within the enemy, do not need the fiction of postliminy on account, because their ownership by the law of nations has not yet changed.”

“§ 79 Equitable conversion. Where… money invested for the benefit of certain beneficiaries, equity regards- especially for purposes of devolution- the prospective sale or investment as if it had taken place at the time the will or deed took effect; this is usually called the doctrine of equitable conversion. Historically, the adoption of such a rule owed much to the influence of the maxim that equity regards that as done which ought to be done; …“ There are some limitations to this conversion. “…the rule does not operate to deprive a widow of her dower right. Where the beneficiaries are all sui juris and agree to do so, they may before the conversion actually takes place elect to take the property in its original form, because the trustees in such a case must obey the beneficiaries rather than the directives of the creator of the trust; this is usually referred to as the doctrine of equitable reconversion.”

“Thou shalt not lend upon usury to thy brother; usury of money, usury of victuals, usury of any thing that is lent upon usury:” (De 23:19)

“He who knows nothing is nearer to the truth than he

whose mind is filled with falsehoods and errors” Thomas Jefferson

Monetary Summary

Everything that is purchased with a note has not actually been paid for with present value. A person merely offers [tenders] the note [bill] for legal payment in order to discharge a portion of the debt. The one who has promised, under seal, to pay the debt holds in trust the equitable title, while the person tendering his note obtains a mere legal title. This process is called “equitable conversion” and arises out of a construction of law. In order to obtain a true and actual title and equitably reconvert the property, one must pay present value to the one holding the equitable title.

“None are more hopelessly enslaved than those who falsely believe they are free.”

An individual must pay present value and have the capacity to own property. Citizens of the United States still can not use gold as currency. Individuals cannot reap the benefits of the trust while claiming to be immune from the debts of the trust. An individual must be sui juris.

If an individual pays present value for property with gold or silver to someone else who is a citizen in the trust, but only has a legal title, can he claim to have broken off the equities? Or should he do more?

“But the doctrine of constructive trust has an important limitation: it is not enforced against a transferee who had both paid value and received title before notice of the trust or other equity.” but “A purchaser from a known trustee who has the authority to sell need not see the proper application of the purchase money.”

“Delivery cannot and ought not to transfer to him who receives more than was in possession of him who made the delivery.”

Purchasing with present value from someone who has legal title does not break the interest of the one holding an equitable title in trust.

“No one can grant or convey what he does not own.”

There still may be a value in the old notes to directly pay the holder of the equitable title, though a known trustee may not have the authority to sell, but may be compelled to by preexisting circumstances.

Those original Federal Reserve Notes are still under seal. The treasury no longer has the gold to pay out for those notes at face value, but they do have substance. They have the equitable title to all the property you hold the legal title to. If they change the nature of this merely constructive trust from a three party to a two party trust or change the relationship of any of the parties involved in the trust, then it is only reasonable that all have an option to change their relationship, also.

Shall I count [them] pure with the wicked balances, and with the bag of deceitful weights? (Mic 6:11)

“One who gives up a pre-existing claim against T in exchange for trust property should be and is considered as having given up present value; and the tendency is toward protecting one who merely accepts trust property as collateral security for a pre-existing debt, the value being found in the forbearance to sue.”

These notes under seal, and the agreement that allows them to come into existence, preexisted the trust. Therefore, the claim for payment existed before the trust and the tendency is toward protecting the preexisting claim.

An example of this mechanism on a national level was seen after October 28, 1977, when it was clear that the United States was no longer going to pay out gold to sovereigns in exchange for the Federal Reserve Notes. Almost every country in the world had already established their own federal-reserve-type monetary system of debt notes and were in as bad a shape or worse than the U.S. Those countries were in no position to put any real pressure on the U.S. and were willing to make concessions and agreements to maintain some sort of economic stability.

Panama used Federal Reserve Notes of the United States and coined some money. They had a large supply of those notes and could continue to demand payment in substance with relative economic impunity. If the United States agreed to transfer the Panama Canal to them, then the government of Panama would waive any right to demand such payment. A treaty was promptly written and signed, granting Panamanian government the canal.

This principle of waiver as payment is similar to what individuals can do in America today. If they waive their right to the preexisting value owed them, it must be considered as having given present value. But this trust has extended to almost every aspect of the lives of the citizens of the United States. An individual must waive rights to all the privileges offered by the United States Government to its subjects. They must become free and natural individuals. They must waive their right of redemption in one system and be redeemed in another, in order to seisi the land they wish to truly possess under that heavenly government they wish to live in .

[There is another door. Though the sealed notes are quickly disappearing from circulation as they are replaced with the new notes there is another hope. As the door to liberty and a free dominion closes there is another preexisting debt of the world system in innocent blood that can liberate the people from bondage. ]

“How doth the city sit solitary, [that was] full of people! [how] is she become as a widow! she [that was] great among the nations, [and] princess among the provinces, [how] is she become tributary!” (La 1:1)

“I believe there are more instances of the abridgment of the freedom of the people by gradual and silent encroachment of those powers than by violent and sudden usurpation.”

It has been man’s turning away from God’s ways. His desire for the wealth, benefits, and comforts of those worldly regimes and their boastful words that has seduced man into his present bondage. The right and authority to impose an excise tax (tribute) on land or labor, is based on the inadequacies of a legal title having been equitably converted, just as in the days of the Pharaoh.

“And through covetousness shall they with feigned words make merchandise of you: whose judgment now of a long time lingereth not, and their damnation slumbereth not.” (2Peter 2:3)

Are today’s usurers as forgiving as the usurers in the time of Nehemiah or have they followed after Rehoboam?

“For all nations have drunk of the wine of the wrath of her fornication, and the kings of the earth have committed fornication with her, and the merchants of the earth are waxed rich through the abundance of her delicacies. And I heard another voice from heaven, saying, Come out of her, my people, that ye be not partakers of her sins, and that ye receive not of her plagues. For her sins have reached unto heaven, and God hath remembered her iniquities.” (Revelation 18:3, 5)

“To equitably reconvert sets a man between the Red Sea and a hardhearted Pharaoh with but the song of Moses and the Lamb. And they sing the song of Moses the servant of God, and the song of the Lamb, saying, Great and marvellous [are] thy works, Lord God Almighty; just and true [are] thy ways, thou King of saints.” (Re 15:3)

“But the mount Zion shall be deliverance, and there shall be holiness; and the house shall be holiness; and the house of Jacob shall possess their possessions.” (Obadiah 1:17 )

It should be clear that even though you may discharge the debt of a mortgages and obtain legal titles you still do not have clear and good titles, which “are synonymous; ‘clear title’ meaning that the land is free from encumbrances, ‘good title’ being one free from litigation, palpable defects, and grave doubts, comprising both legal and equitable titles and fairly deducible of record.”

“Also, the merchants of the earth are weeping and mourning over her, because there is no one to buy their full stock anymore, full stock of gold and silver and precious stones, and of pearls, and fine linen, and purple, and silk, and scarlet, and all thyine wood, and all manner vessels of ivory, and all manner vessels of most precious wood, and of brass, and iron, and marble, And cinnamon, and odours, and ointments, and frankincense, and wine, and oil, and fine flour, and wheat, and beasts, and sheep, and horses, and coaches and slaves and human souls. “(Revelations 18:11, 13.)

Who has bought the earth with lies and subtle tricks? Who are those who have sought to be gods, but are no God?

“Be not thou [one] of them that strike hands, [or] of them that are sureties for debts.” (Pr 22:26)

How could all this happen? Ask the modern media.

“We’re grateful to the Washington Post, the New York Times, Time Magazine and other great publications whose directors have attended our meetings and respected their promise of discretion for almost 40 years. It would have been impossible for us to develop our plan for the world if we had been subjected to the lights of publicity during those years. But, the world is more sophisticated and prepared to march towards a world government. The supranational sovereignty of an intellectual elite and world bankers is surely preferable to national auto-determination practiced in past centuries.”

“We are going to impose our agenda on the coverage by dealing with issues and subjects that we choose to deal with”

“Our job is to give people not what they want, but what we decide they ought to have.”

“The Federal Reserve system pays the U.S. Treasury 020.60 per thousand notes -- a little over 2 cents each-- without regard to the face value of the note. Federal Reserve Notes, incidentally, are the only type of currency now produced for circulation. They are printed exclusively by the Treasury's Bureau of Engraving and Printing, and the $20.60 per thousand price reflects the Bureau's full cost of production. Federal Reserve Notes are printed in 01, 02, 05, 10, 20, 50, and 100 dollar denominations only; notes of 500, 1000, 5000, and 10,000 denominations were last printed in 1945.”

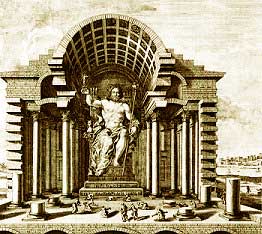

It was not mere superstition that motivated them, but a practicality stimulated by fear and a lack of faith. The people literally deposited their gold, as well as other goods, sacrificed the right to it, and took, in turn, some sort of exchangeable token. The gold was poured into a large statue for all to see. The wealth of the community was melted together. No one person could leave in the face of an enemy or trouble without leaving behind the golden idol. His scarabs or tokens were worthless except at his community. The priests of the temple kept track of all the complexities of this monetary system and, of course, the profits from interest and usury.

This was a common plan found in many governments of that day and this. They deposited their family wealth in a central vault controlled by trusted men of government, in this case the golden calf was their “reserve fund”. Moses understood how it was a wicked thing to bind the people by anything more than love for one another, a passion for mercy and justice and the way of God the Father.

Greek geographer Strabo wrote of a 40-foot-high, gold-and-ivory, statue of the ruler of the gods seated on a throne. "It seems that if Zeus were to stand up, he would unroof the temple."

Footnotes:

|